Generally Accepted Accounting Principles (GAAP) are standardized guidelines designed to ensure consistency in financial reporting, including revenue recognition.

The concept of revenue recognition has a fundamental role in business practices, as it determines the timing and method of recording earnings from sales or other sources in financial statements. This process guarantees that revenue is reported when it's genuinely earned, providing a transparent and accurate representation of a company's financial position and health.

Odoo is an excellent choice for companies seeking to simplify their accounting processes while meeting regulatory requirements. This article will explore how Odoo supports GAAP compliance and enhances revenue recognition.

Understanding Revenue Recognition under GAAP

According to GAAP, revenue should be recognized when it is earned, regardless of when the payment was received. This means that revenue is recorded when the goods or services have been delivered to the customer, and the customer is legally obligated to pay. To put it simply, the revenue is recognized once it’s realized and earned, not when the company possesses the money.

GAAP outlines a five-step model established by the ASC 606 (Accounting Standards Codification nº 606), which guides the measurement of the performance obligations over time, for revenue recognition, ensuring a systematic approach to recording revenue:

- Identify the Contract: Determine if a contract exists between the business and its customer.

- Identify Performance Obligations: Identify the distinct goods or services that the business has promised to deliver.

- Determine the Transaction Price: Ascertain the amount the business expects to receive in exchange for delivering the promised goods or services.

- Allocate the Transaction Price: Allocate the transaction price to each specific performance obligation.

- Recognize Revenue: Revenue is recognized when the business satisfies each performance obligation, typically when the customer takes control of the goods or services.

Why Does GAAP Compliance Matter?

Adhering to GAAP principles is essential for accurate financial reporting and for avoiding legal issues. Non-compliance can lead to financial restatements, legal penalties, and loss of investor trust. By following GAAP properly, businesses ensure that their financial statements are reliable, which is crucial for decision-making by management, investors, and regulators.

How Odoo Facilitates GAAP-Compliant Revenue Recognition

Odoo seamlessly integrates GAAP principles into its accounting module, allowing businesses to apply the five-step model within their financial processes. The system's flexibility enables businesses to tailor their revenue recognition practices according to their specific needs while staying within GAAP guidelines.

- Invoicing: Odoo’s invoicing feature allows your business to generate invoices that reflect your transaction price and performance obligations accurately. This ensures that revenue is recognized in alignment with GAAP standards.

- Contract Management: The contract management feature in Odoo helps your business manage complex contracts with multiple performance obligations. It allows users to track and allocate revenue based on the terms of the contract, ensuring compliance with the GAAP revenue recognition model.

- Automated Revenue Recognition: Odoo’s automation capabilities simplify the revenue recognition process. Your business can now set up automated workflows that trigger revenue recognition based on your own customized and present criteria, reducing manual intervention and the risk of errors.

A Case Study

Consider a software company that sells a contract-based service. The company signs a one-year contract with a customer, with payment received upfront. Under GAAP, the company cannot recognize the full payment as revenue immediately. Instead, the revenue must be recognized over the contract period as the service is provided.

To implement this in Odoo follow these steps:

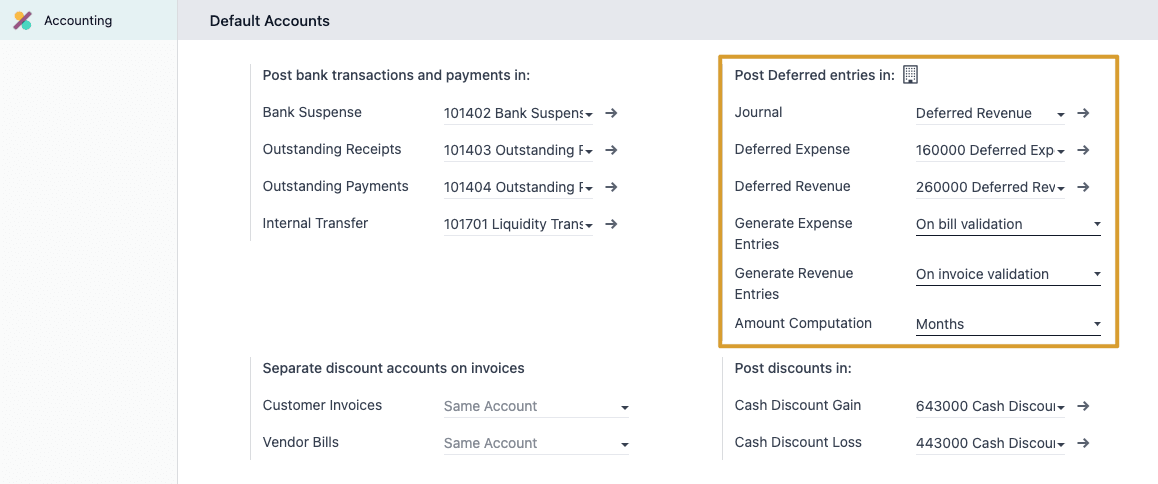

- In settings, assign the default deferred accounts to automate the posting process, so that the system will accurately handle deferred revenue for every transaction.

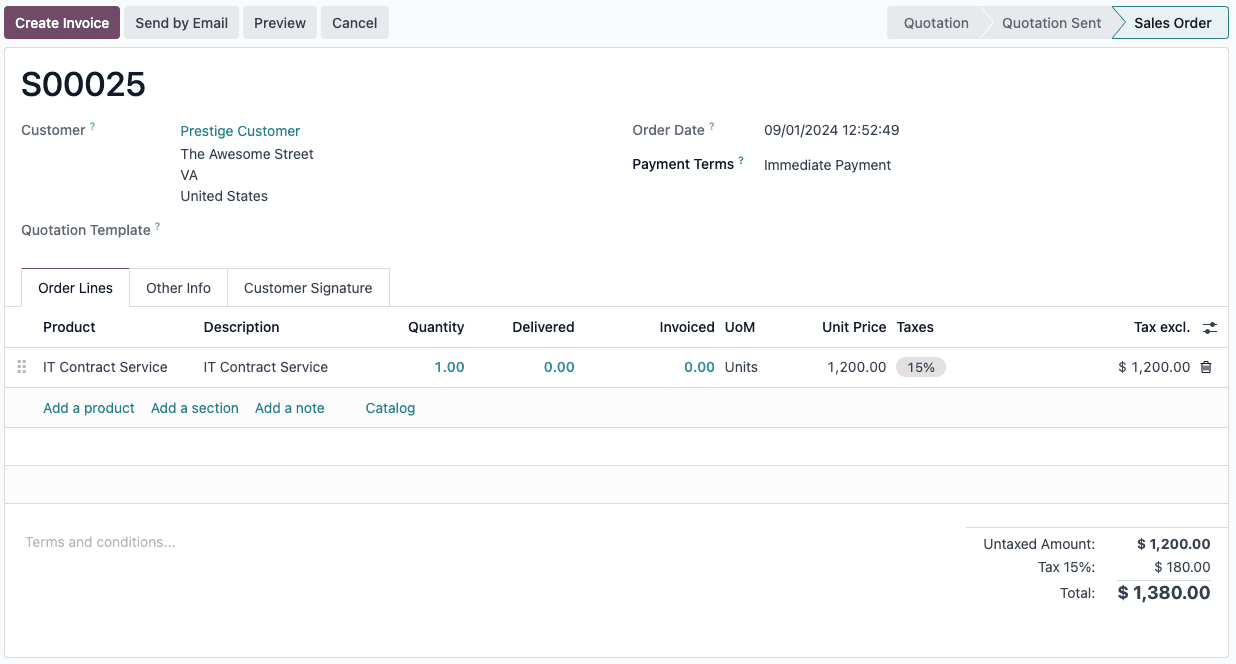

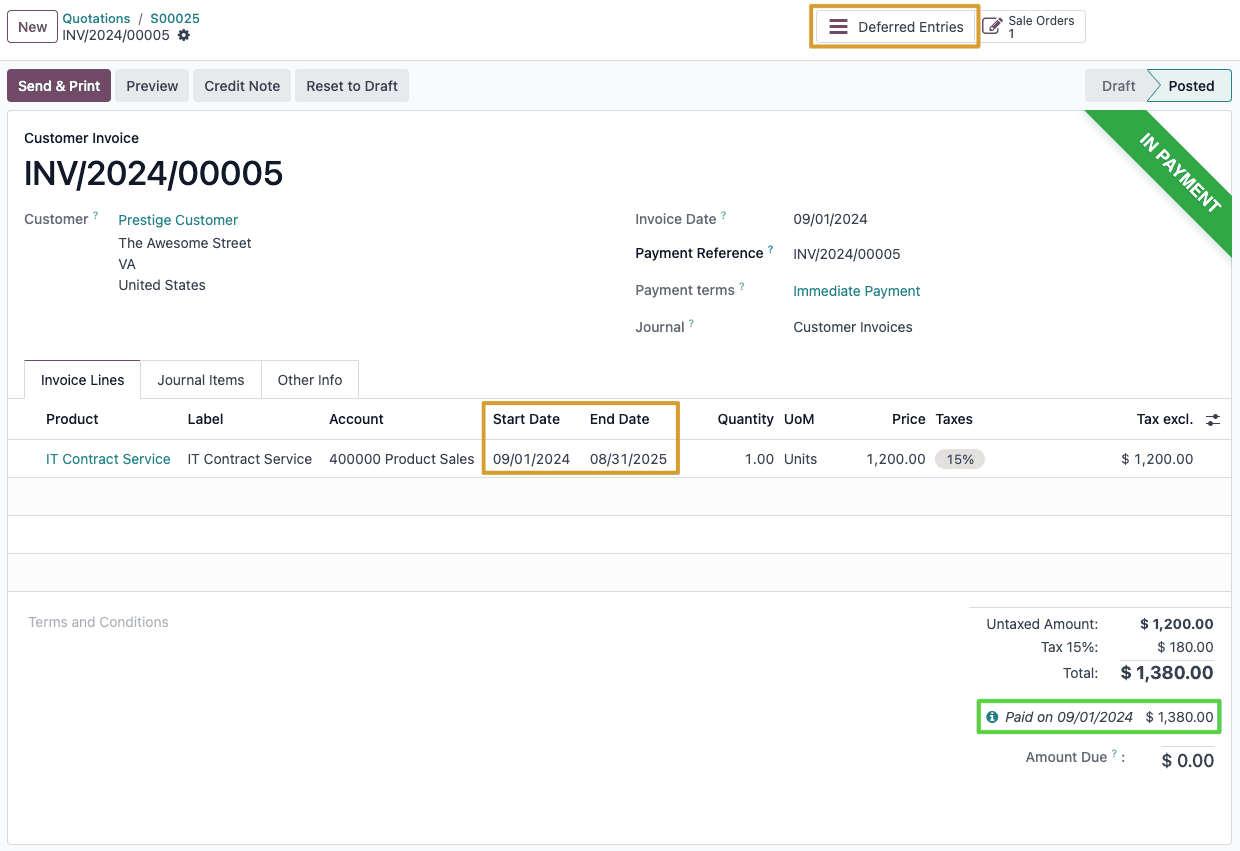

- After the contract is signed, generate a Sales Order for the annual service.

- Next, issue the invoice to reflect the upfront payment.

- While the invoice is still in draft, input the start and end dates of the contract on the invoice line. This triggers the automatic creation of journal entries that allocate the revenue across the 12 months.

- Each month, Odoo will automatically post the appropriate revenue portion, ensuring that the revenue is reported accurately and in alignment with the service delivery, as well as in compliance with GAAP.

Why Choose Odoo?

Odoo is an effective solution for businesses looking to simplify revenue recognition while ensuring full GAAP compliance. Automating processes and minimizing errors, enhances financial reporting accuracy and builds stakeholder confidence, whether you're a small startup or a growing enterprise. If you're ready to optimize your revenue recognition, we invite you to explore Odoo with us.

Follow Us On Social Media

Stay connected with ERPGAP and follow us on this journey. You can view updates on LinkedIn and Twitter.