Introduction

Odoo is a leading Enterprise Resource Planning (ERP) solution perfectly suited for today's dynamic business environment. Robust integrated systems help you manage your company better, which is why Odoo offers seamless integration with multiple business modules.

These modules work together to automate your repetitive tasks, minimize errors, and save you time. The system ensures compliance with regulatory standards by providing detailed audit trails and ensuring transparency & accountability in all of your financial transactions.

Adding to these features, Odoo's user-friendly interface and role-based access control enhance user-friend liness and overall efficiency across all departments. Equipped with advanced budgeting, forecasting, and analysis tools, Odoo enables your organization to plan more effectively and make informed decisions based on accurate data.

This article explores the top five specific accounting features that make Odoo a keen choice:

- Multi-currency support

- Bank reconciliation

- Accounts payable and receivable management

- Budgeting and forecasting

- Advanced analytics and dashboards

These features demonstrate how Odoo meets the complex needs of modern businesses by providing a comprehensive accounting solution.

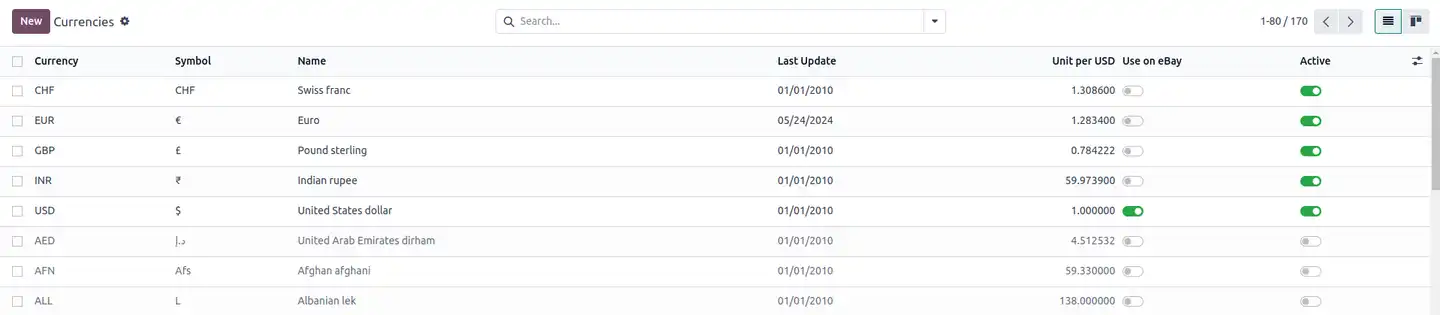

1. Multi-Currency

Global transactions

Odoo's multi-currency support is invaluable for your business if it trades globally. It allows global businesses to easily handle transactions in different currencies, a feature that is especially beneficial if you operate in multiple countries or deal with international customers and suppliers

For example: if your company is based in the US and exports products to Europe and Asia, you can now easily manage sales, purchases, and payments in Euros, Yen, or other currencies. Odoo's multi-currency support ensures that your financial transactions are accurately recorded and reflect the correct currency amounts and exchange rates. This simplifies financial management across all your relevant markets.

Real-time exchange rates

Odoo extends its multi-currency functionality by automatically updating the exchange rates you work with. The system can integrate with external exchange rate providers to obtain the latest rates, ensuring that all your transactions are recorded at real-time exchange values. This automatic update feature is critical for accurate financial reporting and the compliance of your company with international accounting standards.

For example: when a payment is received from your international customer, Odoo uses the latest exchange rate to convert the amount into that company's base currency, guaranteeing the accuracy of your financial records. This reduces the risk of errors associated with manually updating exchange rates, helps your company comply with financial regulations, and provides a reliable basis for financial analysis and better decision-making.

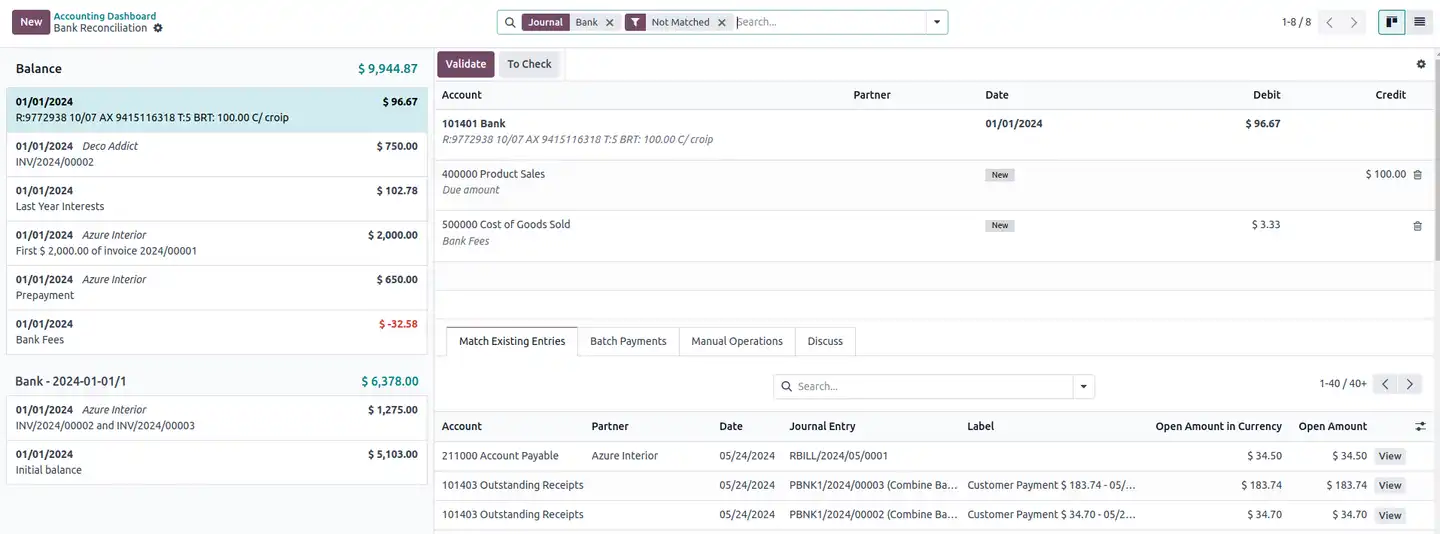

2. Bank Reconciliation

Automated reconciliation:

Odoo's automated reconciliation feature is designed to simplify those time-consuming, error-prone processes of reconciling bank statements with your accounting records. The system uses sophisticated algorithms to automatically identify and match all your transactions with corresponding entries in the company's records. This automation significantly reduces repetitive tasks in the reconciliation process.

For example: if a payment from a customer appears on your bank statement, Odoo can automatically match it to the corresponding invoice in its system. This not only speeds up the reconciliation process, but also minimizes the risk of human error. It also ensures that bank accounts are accurately and consistently reflected in your financial records.

Import and synchronize bank statements:

Odoo further simplifies your bank reconciliation process by allowing you to directly synchronize with the bank to obtain statements. It’s now possible to import your bank statements directly into this intuitive system!

You can upload electronic bank statements in CSV, OFX, or QIF—depending on the format each bank provides. Once the statements are imported or synchronized, Odoo analyzes the transactions and suggests matches for outstanding payments and receipts.

For example: if one of your vendor payments listed on a bank statement matches an unpaid invoice in Odoo, the system will propose this match and allow the user to confirm it quickly (or even automatically if configured in the system settings). This feature not only speeds up the reconciliation process, but also increases accuracy by reducing the manual data entry associated with your typical reconciliation methods. You can now reconcile multiple bank accounts within Odoo itself, making it a versatile tool for managing all your complex financial operations.

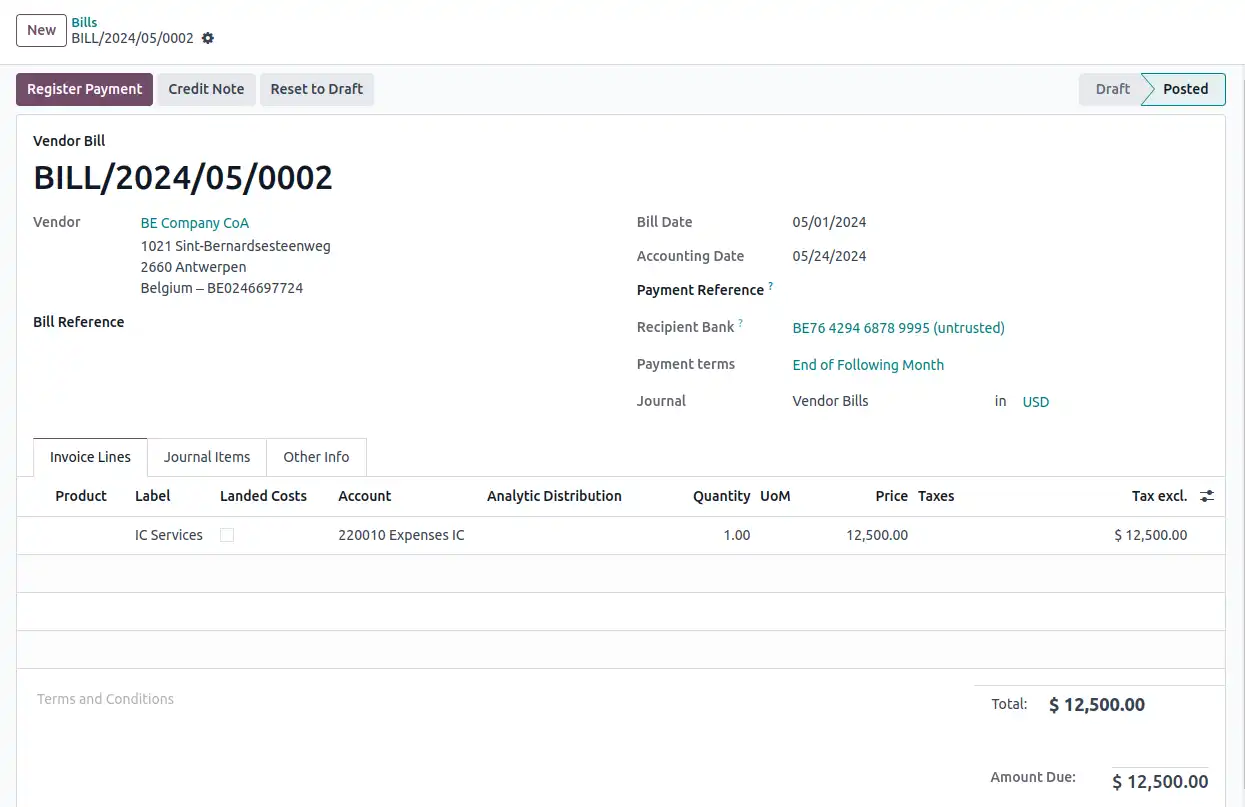

3. Accounts Payable and Receivable Management

Efficient Invoicing

Odoo offers your company a comprehensive set of software tools to create, send, and manage customer or vendor invoices. You will be able to generate more professional-looking invoices directly from Odoo’s system, customizing them to be consistent with your brand theme, logo, terms & conditions, etc.

Invoices can then be automatically emailed to customers or printed for posting. Odoo also allows you to track the status of your invoices, alerting you to invoices that have been sent, viewed, and/or paid. This centralized invoicing process facilitates operations and ensures that invoices are managed much quicker and more accurately.

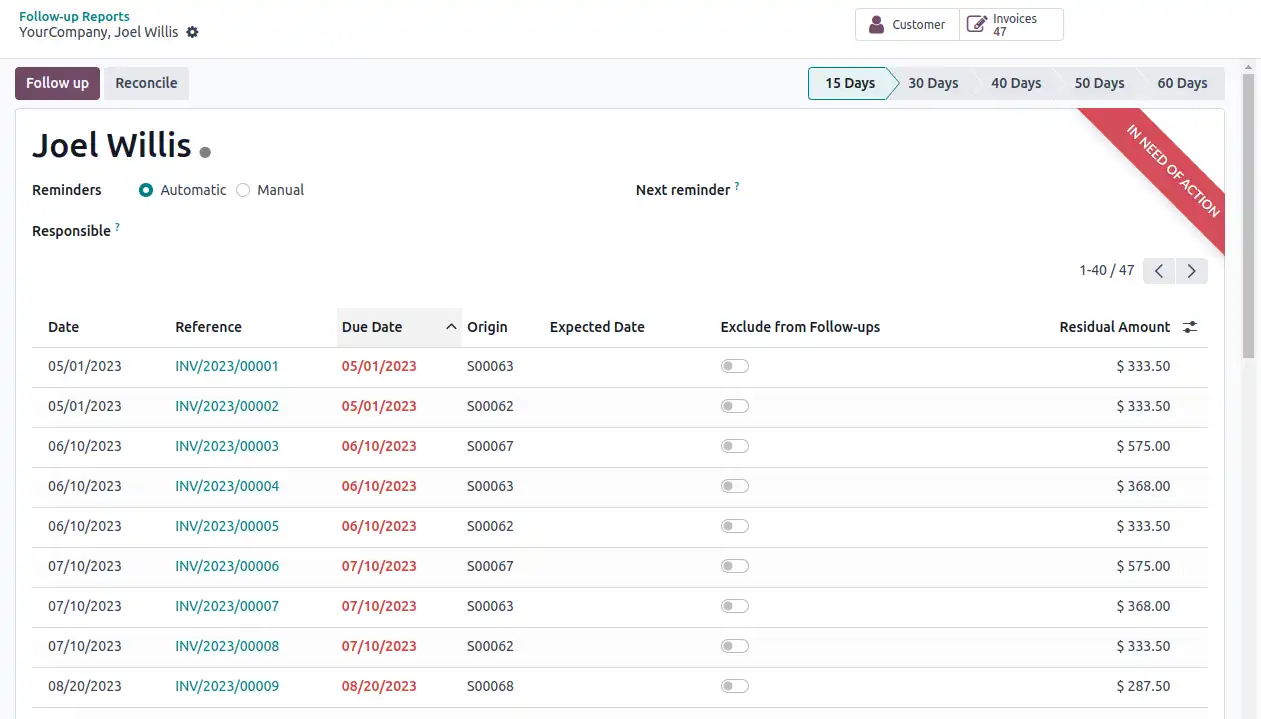

Automate overdue notices

One of the key features you’ll appreciate about Odoo's invoicing module is its ability to set up automated reminders for overdue payments. You’ll be able to configure Odoo’s system to send reminder emails to customers with outstanding invoices, reminding them to pay.

These automated reminders will help you to improve cash flow by implementing timely collections while reducing the risk of late payments or bad debt. By automating the follow-up process, Odoo frees up your financial team’s time, allowing them to focus on more strategic tasks.

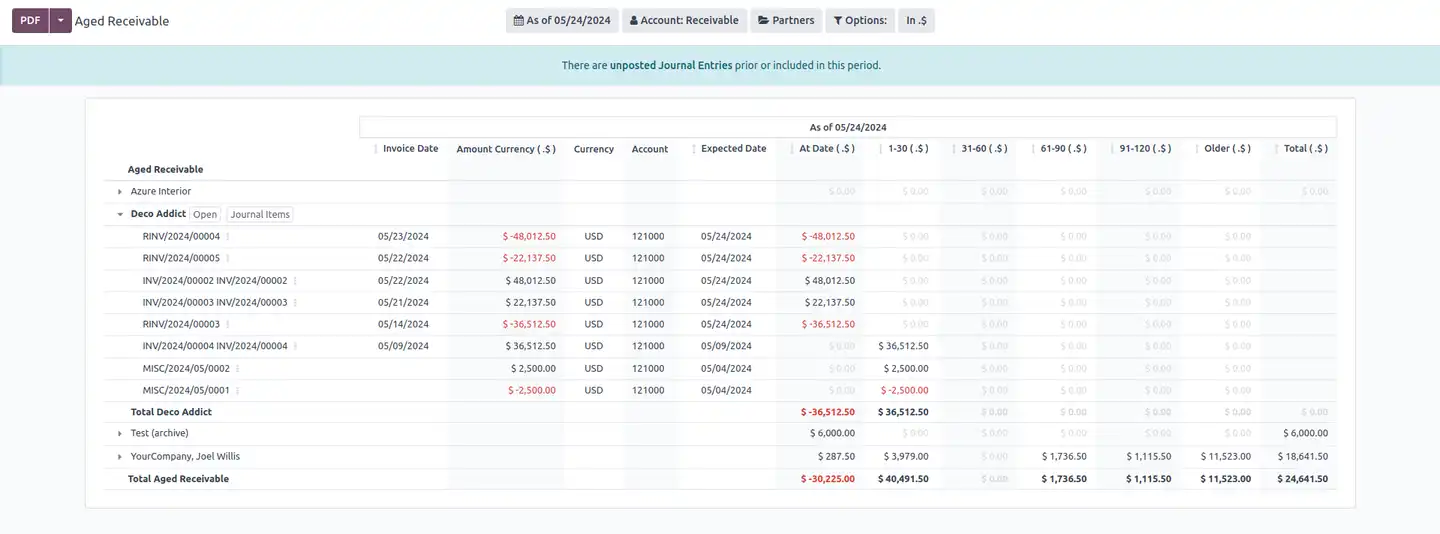

Aging reports

Odoo also provides aging reports for accounts receivable and accounts payable, giving you valuable insight into the financial health of your business. These reports categorize outstanding invoices and bills according to dates. These are typically divided into 30-day, 60-day, 90-day, and past-due categories. By analyzing aging reports, organizations can track outstanding invoices or bills, assess customer payment patterns, and predict cash flow issues.

For example: if a significant portion of your accounts receivable is aging beyond normal terms, it may indicate that you need to review credit policies or more aggressively pursue non-paying customers. Similarly, aging reports for accounts payable can help your company manage payment obligations, avoid late fees, and maintain positive relationships with your vendors. Odoo's aging reports enable you to make more informed decisions regarding your credit management, cash flow forecasting, and collection strategies.

4. Budgeting and Forecasting

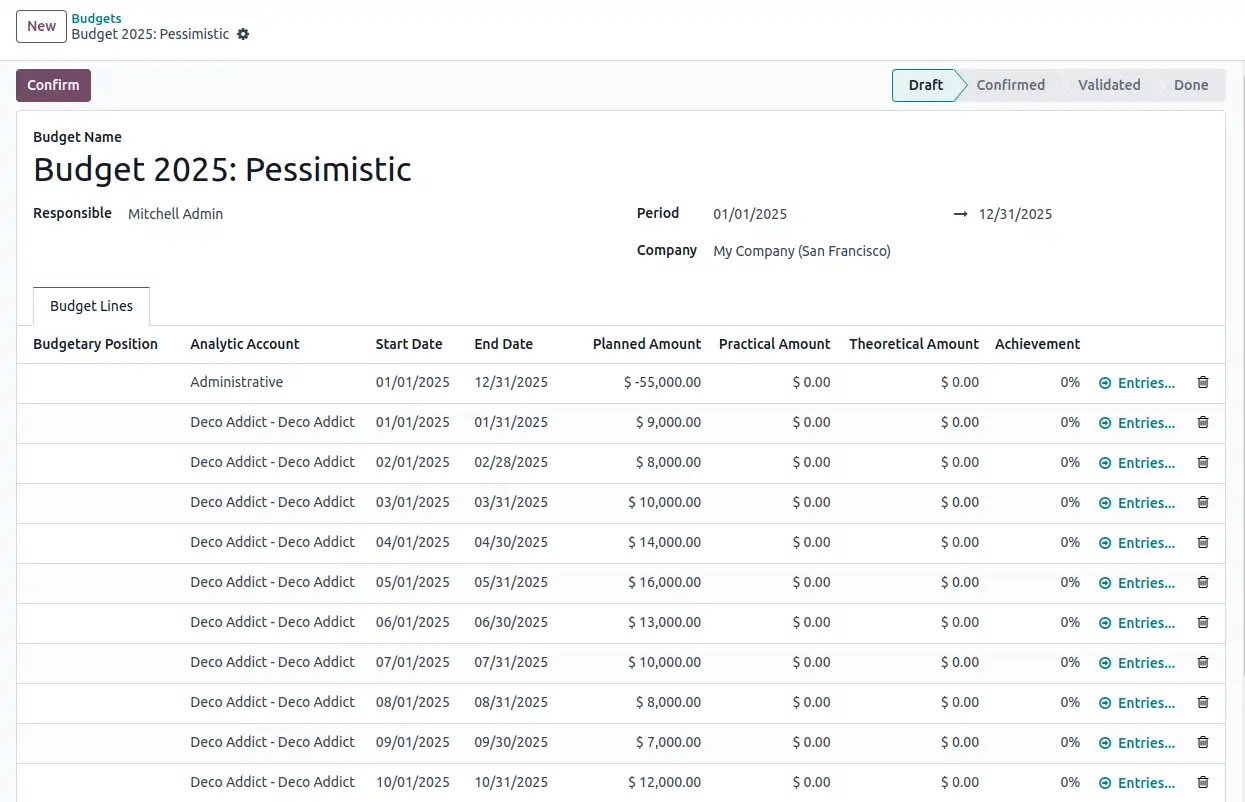

Budget management

Odoo provides robust tools for creating budgets and progressively managing them. These tools are essential for proper financial planning. They enable your business to set budgets for different departments or even your entire organization. They also define specific budget goals and allocate resources.

For example: your company can create a marketing budget that allocates funds to different campaigns and then track its spending against that budget throughout the fiscal year. Odoo's budgeting module allows you to compare actual spending with budgeted amounts, providing real-time visibility into financial performance.

This feature helps your managers identify areas where spending is over or under budget, allowing for adjustments and control of financial resources. Odoo can also handle multiple budgets simultaneously, which is particularly useful if you have a complex organization with multiple financial needs.

Financial forecasting:

Odoo's financial forecasting tools are designed to help you predict future financial results based on historical data and current trends. By using these tools, your company can forecast revenues, expenses, and general cash flow with greater accuracy.

For example: Odoo can analyze your past sales data to project future sales volumes and revenues. It can even use expense trends to estimate your future operating costs. This forecasting capability is invaluable for your strategic planning, allowing your company to budget appropriately and capitalize on upcoming opportunities.

Financial forecasting in Odoo also supports scenario analysis, allowing you to model different financial outcomes based on various assumptions of certain conditions. This helps you to make informed decisions about investments, allocate your resources, strategize growth, and ensure that your company remains financially safe and prepared for the future.

Odoo's budgeting and forecasting capabilities are essential to maintaining the financial health of your business, while helping you achieve long-term business success. By providing detailed insight into budget performance and future financial trends, these tools enable your organization to plan, manage resources, and make decisions based on predictive data.

5. Advanced Analytics and Dashboards

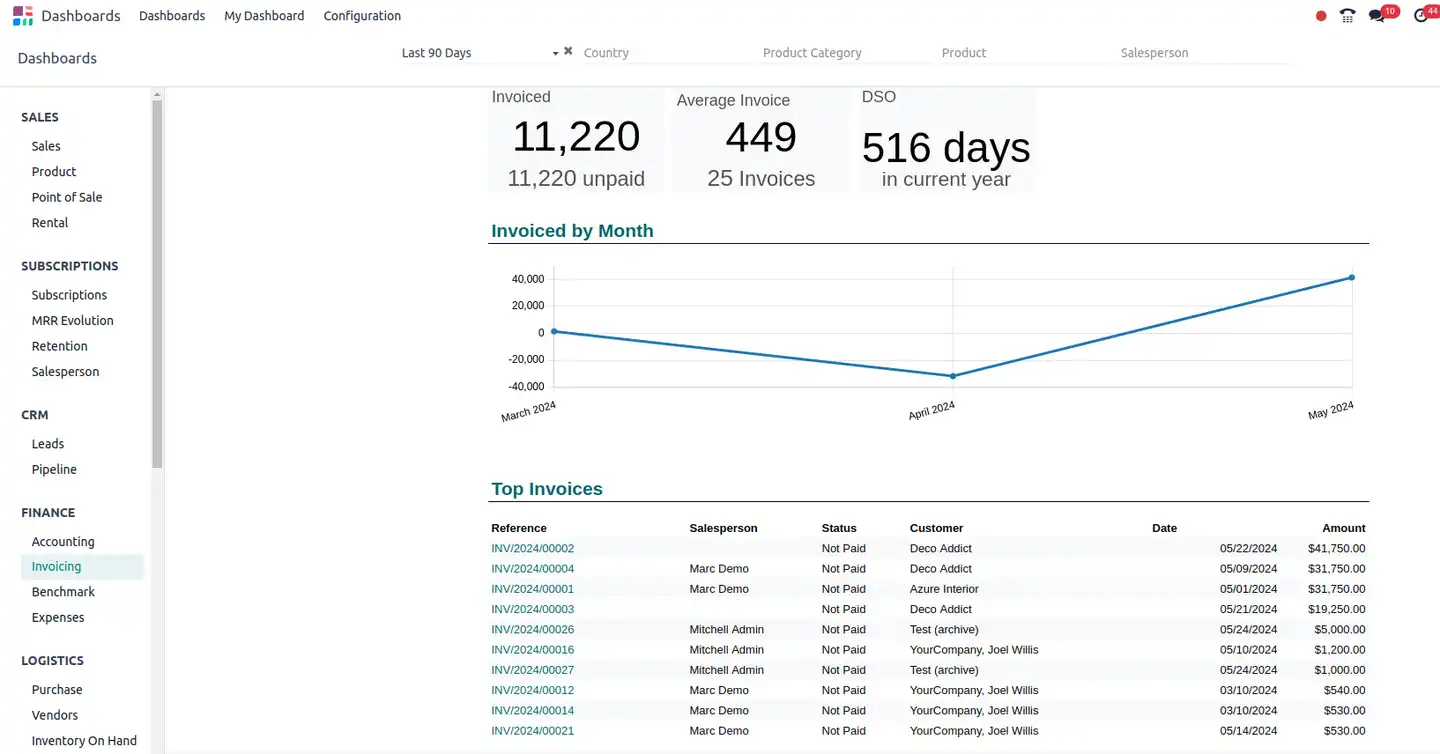

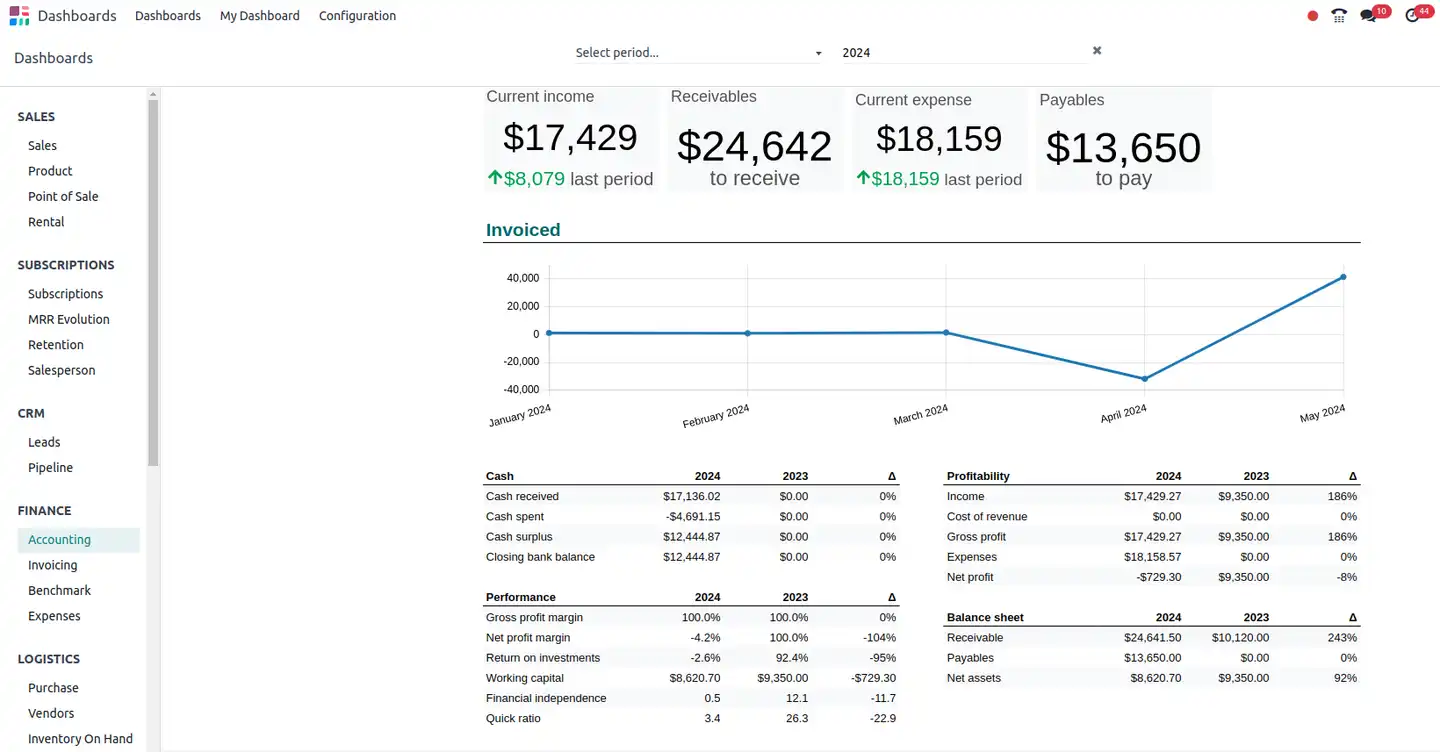

Data Visualization

Odoo's accounting module is equipped with advanced analytics and customizable dashboards that provide powerful visual insights into key financial metrics. You’ll be able to create graphs, charts, and KPIs to track your company’s financial health.

For example: as a CFO you’d have the ability to set up a dashboard and view real-time data on cash flow, revenue trends, and expense breakdowns. This will help you to quickly assess the company's financial health. These tools are visual, so they make complex financial data easier to understand, helping stakeholders quickly grasp important information and enabling them to make informed decisions.

Drill-down capability

You can click on any data point or metric within a graph or chart to see the underlying transactions that contribute to that number.

For example: if a sales graph shows an unexpected drop in revenue for one of your months, you’d be able to drill down to examine the specific invoices, customer orders, or product sales that caused that drop. This feature eliminates the need to navigate through multiple reports on countless different pages, giving you detailed information fast.

These advanced analytics and dashboard capabilities highlight Odoo's ability to comprehensively address the needs of accountants, as well as managers who may not possess complex accounting knowledge.

By offering powerful visualization tools and detailed data access, Odoo improves your financial management overall. These tools make it a versatile and indispensable system for modern companies who are looking to achieve excellence in their operations and growth.

Conclusion

The goal here is ultimately to grow in a sustainable way and operate with excellence. Odoo's comprehensive suite of accounting features, including multi-currency support, automated bank reconciliation, efficient invoicing, robust budgeting and forecasting tools, and advanced analytics, make it an exceptional ERP solution.